0+ Years Experience

Based on the work of Dr. Ken Long, Ph.D.

Second Generation BMR/Core Systems

What Are Monthly Trading Systems?

Why Are These Called “Monthly Asset Allocation Systems”?

This approach offers:

- Time efficiency – execution takes just minutes per month

- Reduced stress – no need for constant monitoring

- Adaptability to changing market conditions

- Disciplined rules-based decision-making

Where Do These Systems Come From?

These systems were originally developed by Dr. Ken Long and taught at the Van Tharp Institute, where they were known as first-generation BMR/Core systems. Building on this work, the second-generation systems we currently teach here represent an evolution and enhancement of the original BMR/Core systems. With the influence and encouragement of Dr Ken Long, the second-generation systems were developed by Van Tharp Institute instructor and Super Trader participant Bill Scheidt.

What’s the Difference Between the First and Second Generation Systems?

Both systems leverage the academically researched concept of momentum, operate on a monthly timeframe, are designed for ease of execution, and take minutes per month to operate. However, the second-generation systems introduce several enhancements, including:

-

- Enhanced momentum calculations incorporating a relative strength component.

- Portfolio moving averages as a second option to the momentum framework.

- Expanded momentum look-back periods for greater flexibility.

- Optional volatility stops to manage risk dynamically.

- Optional short positions to capitalize on market downturns.

- Broader portfolio selections for diversification.

- Expanded options for the number of holdings per month allowing for tailored strategies.

These refinements make the second-generation systems even more versatile and powerful while maintaining the simplicity and effectiveness of the original approach.

How Do These Systems Perform During Market Crises?

Our monthly asset allocation systems are built with that mindset in mind. They’re designed to avoid major bear markets, and in some cases, even generate strong gains during crises. That provides investors with a significant edge—financially and psychologically—over traditional buy-and-hold strategies.

Performance Highlights from Major Market Crises:

- During both the 2008 financial crisis and the 2020 Covid crash, all three of our flagship monthly asset allocation systems made money (BMR 21, PMA SPY and the Hybrid system).

- During the COVID crash, the Hybrid system returned 92.5% and made money while the S&P fell more than -30%.

- During the 2008 crisis, PMA SPY returned 53.6% on a drawdown of only -13.0%.

Are These Black Box systems?

No. The courses for these systems provide all the rules and calculations in complete and exacting detail, reflecting our three core beliefs:

- Black box systems are dangerous to your financial health.

- Good research is reproducible.

- You must trade a system that fits you.

In line with these beliefs, the courses are designed to ensure every student can precisely replicate the systems and research we share. You’ll gain access to the same rules, calculations, assumptions, and methodologies we use—nothing is withheld. Upon completing the course, you will have everything you need to fully understand and execute the systems with confidence.

Not only will you be able to reproduce and verify our methodology and research, but you’ll also gain an in-depth understanding of the versions of the systems we personally trade. This is achieved through the detailed case studies included in the courses. Additionally, the courses provide instruction on how to modify the systems to align with your objectives, ensuring the systems fit you as a trader.

What Kind of Results Do These Systems Produce?

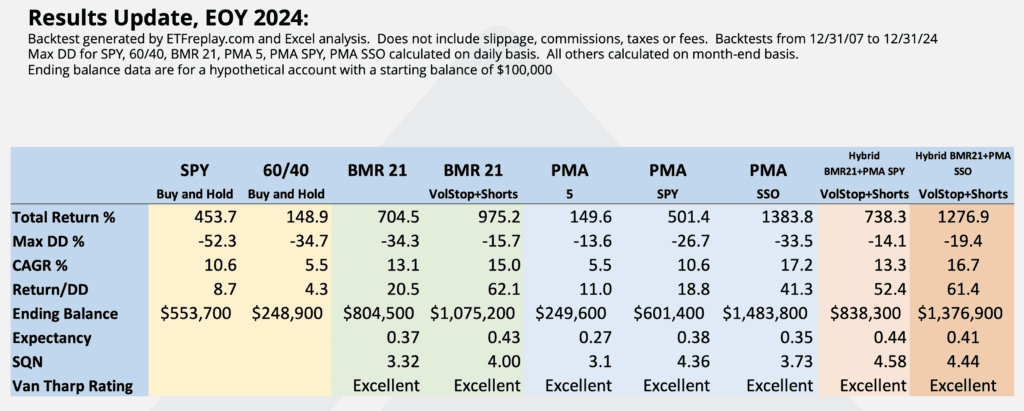

With SQN scores reaching 4.0 and beyond, Dr. Van Tharp would describe these as excellent systems. Our courses not only teach a number of specific systems in detail but also provide extensive content on how you can customize them to align with your specific objectives for risk and return. The courses include numerous case studies demonstrating how these systems have delivered returns greater than the S&P 500 on only a fraction of the drawdown. Check out the screenshot and video below for more details.

Research Newsletter

- Receive periodic research updates. Stay up to speed with market analysis, trading updates, and research findings.

- Get 10% off all our products. All subscribers receive a 10% discount code for all our courses.

About

Mission Statement

Our mission is to serve the financial success and well-being of our community by providing quality trading education.

Values

Integrity – trading systems that work

Quality – world-class education that’s engaging, clear, and inspiring

Service – we’re here to help you accomplish your goals

Dr. Ken Long, Ph.D.

Dr. Ken Long, Ph.D. brings his passion for leadership and teaching into the field of trading where he is a successful professional trader, an accomplished systems developer, and an internationally respected trading coach. He is a retired US Army Lieutenant Colonel with 25 years of active service. He holds a doctorate in management from Colorado Tech University and is an Associate Professor at, US Army Command & General Staff College.

In 1999, Ken founded Tortoise Capital Management which takes a descriptive statistics-based approach to global equity market analysis focusing on capturing low-risk, high-reward recurring opportunities that provide individual traders with a robust edge. Shortly after forming Tortoise Capital, Ken began his 20+ year tenure teaching at the Van Tharp Institute.

Ken’s trading business, Tortoise Capital, currently continues to develop complex trading systems focusing on short and intermediate-term trading opportunities that use Exchange Traded Funds, large-cap stocks, and futures contracts. Ken teaches his market approach methods, well-developed trading systems, as well as his latest innovations through Tortoise Capital programs.

Bill Scheidt

Bill Scheidt has more than 15 years of experience trading stocks, options, commodities, ETFs, and crypto. He credits his studies with Dr. Ken Long and his participation in the Van Tharp Institute’s Super Trader program as the transformational experiences that galvanized his journey to becoming a successful trader.

Bill is the president of Applied Finance Research, the former co-owner of a Registered Investment Advisor firm, a former instructor at the Van Tharp Institute, a participant in the VTI Super Trader program, and the co-founder of The Systems Lab Inc. with Jeff Boccaccio. He researches and develops systems-based strategies for trading and investing, offers consulting and instructional services, and manages private equity.

Bill is a natural instructor and has a talent for helping others in their growth and development. He combines a methodical and scientific approach to trading with a down-to-earth and approachable teaching style. Having undergone the journey from losing trader to profitable private equity manager, he has a unique ability to meet traders where they are and help them get where they want to go.